General information

Since 10 July 2000, Airbus shares have been listed on:

- the Paris Stock Exchange

- the Frankfurt Stock Exchange

- and the Spanish stock exchanges in Madrid, Bilbao, Barcelona and Valencia

Type of shares: Registered shares

Securities Code Number (ISIN Code): NL0000235190

In July 2000 EADS (stock exchange symbol EAD ) was created by merging Aerospatiale Matra of France, DASA of Germany (DaimlerChrysler Aerospace AG excluding MTU Triebwerke) and CASA of Spain (Construcciones Aeronauticas SA). Aerospatiale Matra was already listed on the Paris Stock Exchange prior to the merger. Its shares were then swapped on a one-to-one basis and new shares were issued.

In January 2014, EADS was renamed Airbus Group. As a result, its listing name (Airbus Group) and stock exchange symbol (AIR) were changed. However, its ISIN and Euronext codes remained unchanged. Airbus Group changed its stock market listing name to Airbus in January 2017. Its stock exchange symbol, ISIN and Euronext codes remain unchanged. On 12 April 2017 Airbus Group was renamed Airbus after approval of the respective resolution at the Annual General Meeting of Shareholders.

Airbus is included in the following major indices:

- CAC 40 (French key index)

- DAX 40 (German key index)

- EURO STOXX 50

- STOXX Europe 600

- MSCI World

- FTSE All-World

- MSCI A&D

News and further company-related information can be found on:

- Bloomberg

- AIR:GR

- AIR:FP

- AIR:SM

- Reuters

- AIR-PA

Issued share capital

Airbus shares are exclusively ordinary shares with a par value of € 1. The authorised share capital consists of 3,000,000,000 shares.

Issued shares and voting rights

The figures below show the total number of issued shares and treasury shares as respectively issued and held by Airbus, as well as the resulting aggregate amount of outstanding voting rights.

Last update: 03 March 2026

Status as at 28 February 2026

- Total number of issued shares: 792,283,683

- Total number of treasury shares: 5,055,938

- Aggregate number of outstanding voting rights: 787,227,745

Previous years

Year | Issued as at 1st Jan. | Issued for ESOP | Issued for exercised options | Cancelled | Issued as at 31st Dec. |

|---|---|---|---|---|---|

| 2025 | 792,283,683 | 0 | 0 | 0 | 792,283,683 |

| 2024 | 790,459,434 | 1,824,249 | 0 | 0 | 792,283,683 |

| 2023 | 788,205,008 | 2,254,426 | 0 | 0 | 790,459,434 |

| 2022 | 786,083,690 | 2,052,509 | 0 | 0 | 788,205,008 |

| 2021 | 784,149,270 | 1,934,420 | 0 | 0 | 786,083,690 |

| 2020 | 783,173,115 | 976,155 | 0 | 0 | 784,149,270 |

| 2019 | 776,367,881 | 1,728,840 | 5,076,394 | 0 | 783,173,115 |

| 2018 | 774,556,062 | 1,811,819 | 0 | 0 | 776,367,881 |

| 2017 | 772,912,869 | 1,643,193 | 0 | 0 | 774,556,062 |

| 2016 | 785,344,784 | 1,474,716 | 224,500 | 14,131,131 | 772,912,869 |

| 2015 | 784,780,585 | 1,539,014 | 1,910,428 | 2,885,243 | 785,344,784 |

| 2014 | 783,157,635 | 0 | 1,871,419 | (248,469) | 784,780,585 |

| 2013 | 827,367,945 | 2,113,245 | 6,873,677 | 53,197,232 | 783,157,635 |

| 2012 | 820,492,291 | 5,261,784 | 2,177,103 | (553,233) | 827,367,945 |

| 2011 | 816,402,722 | 2,445,527 | 1,712,892 | (78,850) | 820,482,291 |

| 2010 | 816,105,061 | 0 | 297,661 | 0 | 816,402,722 |

| 2009 | 814,769,112 | 1,358,936 | 0 | (22,987) | 816,105,061 |

| 2008 | 814,014,473 | 2,031,820 | 14,200 | (1,291,381) | 814,769,112 |

| 2007 | 815,931,524 | 2,037,835 | 613,519 | (4,568,405) | 814,014,473 |

| 2006 | 817,743,130 | 0 | 4,845,364 | (6,656,970) | 815,931,524 |

| 2005 | 809,579,069 | 1,938,309 | 7,562,110 | (1,336,358) | 817,743,130 |

| 2004 | 812,885,182 | 2,017,822 | 362,747 | (5,686,682) | 809,579,069 |

| 2003 | 811,198,500 | 1,686,682 |

|

| 812,885,182 |

| 2002 | 809,175,561 | 2,022,939 |

|

| 811,198,500 |

| 2001 | 807,157,667 | 2,017,894 | 809,175,561 |

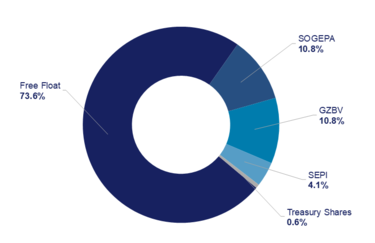

Shareholding structure

Current capital structure

Airbus had 792,283,683 shares issued at 31 December (figures updated every quarter).

SOGEPA , GZBV and SEPI are holding companies for the French, German and Spanish governments respectively.

For the number of shares and voting rights held by members of the Board of Directors and Executive Committee, see the most recent Registration Document (Chapter 4 Corporate Governance) in our Annual Reports section.

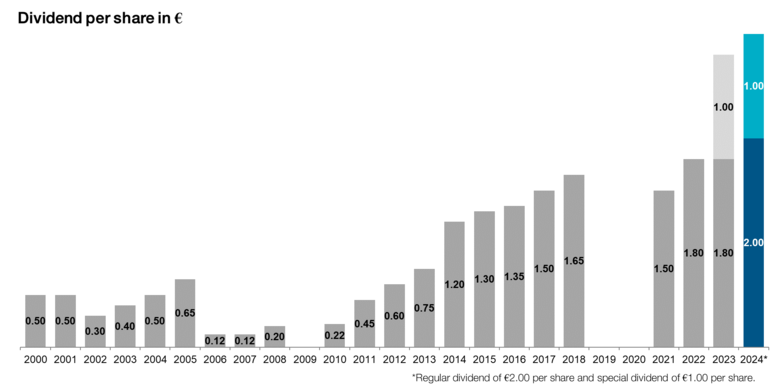

Dividends

Airbus dividend policy

Since 2013, Airbus’ dividend policy has demonstrated a strong commitment to shareholders’ returns. This policy targets sustainable growth in the dividend within a payout ratio of 30%-50%.

Dividend taxation

As of January 1, 2007, based on Dutch tax law, all dividend distributions, independent of the origin/home country of the shareholder, are subject to a 15% dividend withholding tax. For more information please consult a professional tax advisor. See also the most recent Registration Document (Chapter 3 General Description of the company and its Share Capital) in our Annual Reports section.

Unclaimed dividends

Pursuant to Article 31 of the Articles of Association, the claim for payment of a dividend or other distribution approved by the Annual General Meeting of Shareholders shall lapse five years after the day on which such claim becomes due and payable. The claim for payment of interim dividends shall lapse five years after the day on which the claim for payment of the dividend against which the interim dividend could be distributed becomes due and payable.

Dividends and cash distributions paid since the incorporation of the company

Analyst coverage

| Institution | Analyst |

|---|---|

| Agency Partners | Sash Tusa |

| AlphaValue | Saïma Hussain |

| Banco Sabadell | Alvaro del Pozo |

| Barclays | Milene Kerner |

| Berenberg | George McWhirter |

| Bernstein | Adrien Rabier |

| BofA Securities | Benjamin Heelan |

| CIC Market Solutions | Hervé Drouet |

| Citi Research | Charles Armitage |

| Deutsche Bank | Christophe Menard |

| DZ Bank | Holger Schmidt |

| Goldman Sachs | Sam Burgess |

| Jefferies LLC | Chloé Lemarié |

| JP Morgan | David Perry |

| Kepler Cheuvreux | Aymeric Poulain |

| LBBW | Stefan Maichl |

| Metzler | Stephan Bauer |

| Morgan Stanley | Ross Law |

| Oddo BHF | Yan Derocles |

| RBC | Ken Herbert |

| Redburn | Olivier Brochet |

| Santander | Lourdes Dominguez |

| UBS Ltd. | Ian Douglas-Pennant |

| Vertical Research Partners | Robert Stallard |

Share price

For Airbus listing information on Euronext only: © 2019 Euronext N.V. All Rights Reserved. The information, data, analysis and Information contained herein (i) include the proprietary information of Euronext and its content providers, (ii) may not be copied or further disseminated, by any media whatsoever, except as specifically authorized, (iii) do not constitute investment advice, (iv) are provided solely for informational purposes and (v) are not warranted to be complete, accurate or timely.

Airbus share price - chart

Airbus share price - company profile

Airbus share price - historic data lookup

Looking for further information?

The IR team will be happy to assist you

Jean-Christophe Henoux

Head of Investor Relations and Financial Communication

Olivier Prebay

Institutional Investors and Analysts

Victoria Mutton

Institutional Investors and Analysts