Airbus Financing Strategy

- Maintain liquidity and flexibility

- Sufficient level of gross cash at all times in order to manage operational risks and secure our investment into the future

- Committed credit lines

- Short and long-term programmes are in place

- Diversify funding sources and maturities

- Banks: Sustainability-linked Revolving Credit Facility

- Capital markets: in the short term with the French and US Commercial Paper programmes and in the medium and long term with our Euro Medium-Term Note programme, as well as access to the US Debt Capital Market

- Supranationals: European Investment Bank loan

- Anticipate business needs

- Long-term debt instruments to match assets or businesses of long-term nature

- Strict control of customer financing

- Pro-active long-term hedging policy

- Maintain ratings in the single-A category in medium term

- Solid balance sheet

- Efficient presence of Airbus in Debt Capital Markets

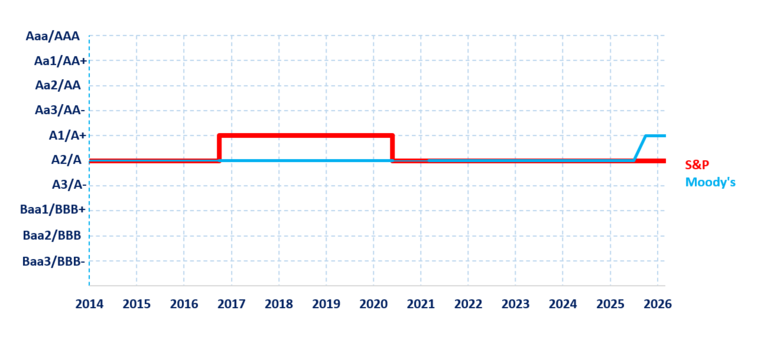

Credit ratings

Rating

To assist debt and fixed income investors to better evaluate the risk of any given investment, the capital market uses the publicly available independent assessments of rating agencies. Through regular discussions with the senior management of companies, rating agencies gain an insight into the strategy and planning of the companies that they rate. Using this information as a base, supplemented by quantitative analysis, rating agencies evaluate the creditworthiness of the issuer companies through a system of rating classifications. Companies which want to raise money in the capital markets in the form of bonds, commercial paper and other debt instruments normally need a minimum of one or, better, two ratings.

The leading international rating agencies are Standard & Poor's, Moody's Investors Service and Fitch Ratings.

The higher the rating classification is, the smaller is the potential risk that a company cannot meet its debt obligations (interest and principal). The debt investors charge a higher rate of interest for financing a higher risk investment. Thus a company with a strong rating can raise capital more advantageously than a company which has a less favourable rating. Additionally, the outlook given by a rating agency provides a supplementary reference point for the investor in assessing the probable development of the rating.

Current Ratings

Rating Agency | Short Term | Long Term | Outlook | Last Update |

|---|---|---|---|---|

Standard & Poor's | A-1 | A | Positive | 18 December 2025 |

Moody's | P-1 | A1 | Stable | 15 September 2025 |

Rating History

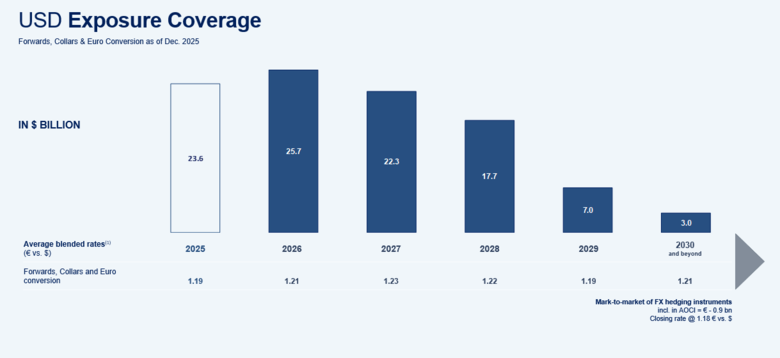

USD Exposure Coverage

Airbus’ currency hedge policy

More than 75% of Airbus' revenues are denominated in US dollars with approximately 60% of such currency exposure 'naturally hedged' by US dollar-denominated costs. The remainder of costs is incurred primarily in euro, and to a lesser extent, in pounds sterling.

As Airbus intends to generate profits only from its operations and not through speculation on foreign currency exchange rate movements, Airbus uses hedging strategies solely to manage and minimise the impact on its EBIT from the volatility of the US dollar.

Airbus manages a long-term hedge portfolio with a maturity of several years covering its net exposure to US dollar sales, mainly from the activities of Airbus Commercial Aircraft and, to a lesser extent, of the Airbus Helicopters and Airbus Defence and Space Divisions. The net exposure is defined as the total firm audited currency exposure (US dollar-denominated revenues), net of the part that is 'naturally hedged' by US dollar-denominated costs. The hedge portfolio covers nearly all of the Airbus hedging transactions.

In parallel, Airbus is proactively increasing the number of euro deals wherever suitable.

The tables below set forth the notional amount of foreign exchange hedges in place and the US dollar rates applicable to corresponding EBIT.

Approximately 60% of Airbus US$ revenues are naturally hedged by US$ procurement.

FX Global Code

The FX Global Code is a voluntary code of conduct having been developed in a joint effort between major central banks and private sector market participants (one of them being Airbus) on a global scale in order to restore trust and to ensure integrity, fairness, liquidity, transparency and effective functioning of the foreign exchange market. Due to its business model and in order to protect its activities from currency fluctuations, Airbus maintains a significant portfolio of foreign exchange hedges. Airbus is therefore committed to the FX Global Code and has already previously been acting in accordance with its leading principles and will continue to do so.

Airbus sees adherence to the code as a way to demonstrate towards its stakeholders compliant behaviours in the context of a wider ethics and compliance framework.

Read more on the Global Foreign Exchange Committee website.

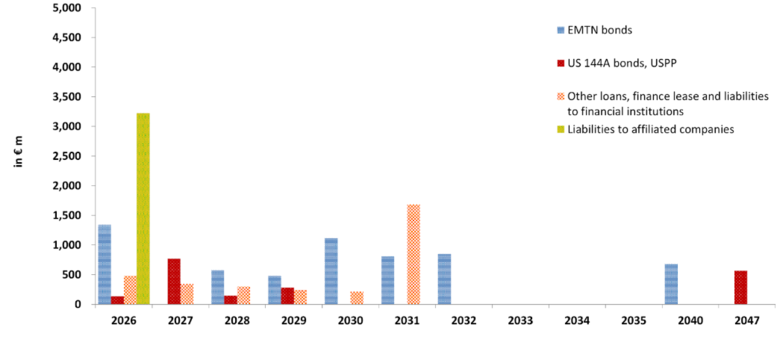

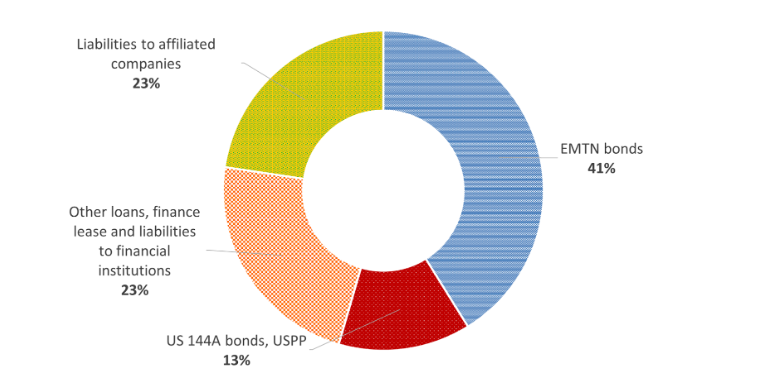

Debt Profile & Portfolio

Funding Tools

Short-term funding

French Domestic Commercial Paper Programme (NEU CP)

Amount | Outstanding | Issuer | Dealer | Status |

|---|---|---|---|---|

€ 11 bn | - | Airbus SE | BNP Paribas, CIC, CA-CIB, HSBC, ING, Natixis, Société Générale | 31 December 2025 |

Euro Commercial Paper Programme

Amount | Outstanding | Issuer | Dealer | Status |

|---|---|---|---|---|

€ 4 bn | - | Airbus SE | BNP Paribas, Commerzbank, HSBC, Lloyds, NatWest Markets | 31 December 2025 |

US Commercial Paper Programme

Amount | Outstanding | Issuer | Dealer | Status |

|---|---|---|---|---|

$ 3 bn | - | Airbus SE | Bank of America Merill Lynch, Citigroup, GoldmanSachs, JP Morgan, MUFG, RBC | 31 December 2025 |

Long-term funding

EMTN Programme

Amount | Outstanding | Issuer | Arranger | Status |

|---|---|---|---|---|

€ 12 bn | € 6.6 bn | Airbus SE | Barclays | 31 July 2025 |

EMTN Bonds

Issue Date | Amount | ISIN | Maturity | Tenor | Coupon | Issuer | Active Bookrunners |

|---|---|---|---|---|---|---|---|

29 Oct. 2014 | €500 m | XS1128224703 | 29 Oct. 2029 | 15 yrs. | 2.125% | Airbus SE | Barclays, CA-CIB, Santander, Unicredit |

13 May 2016 | €461 m €900 m | XS1410582586 XS1410582313 | 13 May 2026 13 May 2031 | 10 yrs. 15 yrs. | 0.875% 1.375% | Airbus SE | BNP Paribas, CA-CIB, Deutsche Bank, MUFG |

31 Mar. 2020 | €611 m €1,000 m | XS2152796269 XS2152796426 | 7 Apr. 2028 7 Apr. 2032 | 8 yrs. 12 yrs. | 2.000% 2.375% | Airbus SE | BNP Paribas / CA-CIB / HSBC / JP Morgan / Société Générale |

2 Jun. 2020 | €894 m €1,250 m €1,000 m | XS2185867830 XS2185867913 XS2185868051 | 9 Jun. 2026 9 Jun. 2030 9 Jun. 2040 | 6 yrs. 10 yrs. 20 yrs. | 1.375% 1.625% 2.375% | Airbus SE | BNP Paribas / CA-CIB / HSBC / JP Morgan / Société Générale |

USD Bond (144A / RegS)

Issue Date | Amount | ISIN | Maturity | Tenor | Coupon | Issuer | Active Bookrunners |

|---|---|---|---|---|---|---|---|

10 Apr. 2017 | $ 750 m $ 750 m | US26824KAA25 US009279AC43 | 10 Apr. 2027 10 Apr. 2047 | 10 yrs. 30 yrs. | 3.15% 3.95% | Airbus SE | JPMorgan, Citigroup, GoldmanSachs, Morgan Stanley |

Committed Credit Facility

Sustainability-linked Revolving Syndicated Credit Facility

Credit line | Outstanding | Maturity | Borrower | Lenders |

|---|---|---|---|---|

€ 8 bn | undrawn | 5 July 2029 | Airbus SE | Pool of 38 banks 3-tier structure |

Further information

Downloads

Airbus - EMTN 2025 - First Supplement

EMTN 2025 Base Prospectus

Negotiable European Commercial Paper

EMTN 2024 Base Prospectus

Airbus_LN_YE-2022

Airbus EMTN 2022 Base Prospectus

Airbus_LN_YE-2021

Airbus EMTN 2022 Trust Deed

Announcement of Substitution

EMTN 2021 Base Prospectus

EMTN Trust Deed 2021

Airbus EMTN Prospectus 2020

EMTN Base Prospectus 2019

First Supplement to the Base Prospectus 2019

Second Supplement to the Base Prospectus 2019

Third Supplement to the Base Prospectus 2019

Fourth Supplement to the Base Prospectus 2019

EMTN 2018 Base Prospectus

EMTN Prospectus 2017

Airbus EMTN Prospectus 2016

EMTN Base Prospectus 2015

EMTN Supplement to 2015 Trust Deed -(Notes due 2026 and 2031)

EMTN Base Prospectus 2014

EMTN Supplement to 2014 Trust Deed (Notes due 2029)

EMTN Base Prospectus 2013

EMTN Supplement to 2013 Trust Deed (Notes due 2024)

Airbus EMTN 2022 Agency Agreement

Downloads

Airbus - EMTN 2025 - First Supplement

EMTN 2025 Base Prospectus

Negotiable European Commercial Paper

EMTN 2024 Base Prospectus

Airbus_LN_YE-2022

Airbus EMTN 2022 Base Prospectus

Airbus_LN_YE-2021

Airbus EMTN 2022 Trust Deed

Announcement of Substitution

EMTN 2021 Base Prospectus

EMTN Trust Deed 2021

Airbus EMTN Prospectus 2020

EMTN Base Prospectus 2019

First Supplement to the Base Prospectus 2019

Second Supplement to the Base Prospectus 2019

Third Supplement to the Base Prospectus 2019

Fourth Supplement to the Base Prospectus 2019

EMTN 2018 Base Prospectus

EMTN Prospectus 2017

Airbus EMTN Prospectus 2016

EMTN Base Prospectus 2015

EMTN Supplement to 2015 Trust Deed -(Notes due 2026 and 2031)

EMTN Base Prospectus 2014

EMTN Supplement to 2014 Trust Deed (Notes due 2029)

EMTN Base Prospectus 2013

EMTN Supplement to 2013 Trust Deed (Notes due 2024)

Airbus EMTN 2022 Agency Agreement

Sustainable Financing

Airbus Green Financing Framework

The Framework reinforces Airbus’ commitment to pioneering sustainable aerospace and aligning part of its funding strategy with communicated environmental goals by establishing a foundation for the issuance of sustainable financing instruments, including green bonds and loans, to support projects with positive environmental impacts.

As Airbus continues to develop technologies which are key to the Company’s foremost ambition to play a leading role in the decarbonisation of the aviation sector, Sustainable Finance is also an opportunity to foster dialogue with the market on these developments.

A Second-Party Opinion (SPO), provided by Sustainalytics, confirms that the Airbus Green Financing Framework is credible, impactful, and aligned with the four core components of the Green Bond Principles 2021 and Green Loan Principles 2023. Also provided, was their view that the Framework is aligned with the EU Taxonomy’s criteria for Substantial Contribution (SC) to its environmental objectives and Minimum Safeguards while communicating that eligible projects are expected to deliver positive environmental benefits.

Please refer to the Sustainability-linked Revolving Credit Facility here above.

The margin of the revolving Credit Facility is linked to one environmental KPI and one social KPI and is adjusted upward or downward depending if KPI’s annual targets are met or not.

Documents

2024

Airbus Green Financing Framework

Sustainalytics Second-Party Opinion

2024

Airbus Green Financing Framework

Sustainalytics Second-Party Opinion

Airbus Finance B.V.

Airbus Finance B.V. was merged into Airbus SE on 31 December 2021. With effect on and from that date, Airbus SE was substituted in place of Airbus Finance B.V. as issuer and principal debtor of the 2024 Notes, 2029 Notes and 2031 Notes (please refer to the Announcement of Substitution).

B.V Documents

Airbus Finance BV Financial Statements HY2021

Articles of Association

Airbus Finance BV - Annual Financial Report - 2020

Airbus Statement of Commitment

B.V Documents

Airbus Finance BV Financial Statements HY2021

Articles of Association

Airbus Finance BV - Annual Financial Report - 2020

Airbus Statement of Commitment

Looking for further information?

The IR team will be happy to assist you

Jean-Christophe Henoux

Head of Investor Relations and Financial Communication

Olivier Prebay

Institutional Investors and Analysts

Victoria Mutton

Institutional Investors and Analysts