Air traffic sustained growth

Airbus' latest Global Market Forecast (GMF) for the 2025-2044 period provides a comprehensive outlook for the evolution of air transportation. Following a robust recovery, the aviation sector is poised for sustained growth driven by societal and economic drivers. This forecast projects significant increase in passenger demand, particularly in Asia and the Middle East, coupled with a transformation towards a more sustainable and efficient global aviation system.

Over the next 20 years, we anticipate a global demand for 43,420 new passenger and freighter aircraft. This will not only cater to growth but also drive the crucial replacement of older, less fuel-efficient fleets.

Key figures

Download documents

2025-2044

Presentation GMF 2025-2044

Summary GMF 2025-44

Airbus Commercial Aircraft GMF 2025-2044

Presentation Cargo GMF 2025-2044

Past years

Presentation GMF 2024-2043

Take away Messages GMF 2024-2043

Infographic GMF 2024-2043

Airbus Commercial Aircraft GMF 2024-2043

Presentation GMF 2023-2042

Take away Messages GMF 2023-2042

Infographic GMF 2023-2042

Airbus Commercial Aircraft GMF 2023-2042

- 2025-2044

- Past years

Presentation GMF 2025-2044

Summary GMF 2025-44

Airbus Commercial Aircraft GMF 2025-2044

Presentation Cargo GMF 2025-2044

Presentation GMF 2024-2043

Take away Messages GMF 2024-2043

Infographic GMF 2024-2043

Airbus Commercial Aircraft GMF 2024-2043

Presentation GMF 2023-2042

Take away Messages GMF 2023-2042

Infographic GMF 2023-2042

Airbus Commercial Aircraft GMF 2023-2042

Air traffic growth driven by people and business

The long-term growth in air travel is underpinned by strong foundational drivers: business and people.

GMF forecasts an increase in air transport (+3.6% passenger traffic mid to long term growth, after a short term rebound) due to an increase in trade (+2.6%), GDP (+2.5%) and world population (+1.2 bn).

- Economic expansion: global Gross Domestic Product (GDP) is projected to grow at an average of +2.5% per year, fuelling business and leisure travel.

- Expanding middle class: an additional 1.5 billion people are expected to join the middle classes globally by 2044, the demographic most likely to travel by air.

- Urbanisation and connectivity: a further 1.3 billion people are anticipated to live in urban centres by 2044, increasing the need for efficient air links.

- Increased affordability: continuous improvements in aviation efficiency and the inherent human desire to connect and explore will further stimulate demand. Air transport affordability is expected to continue to improve thanks to improved aircraft productivity and technology enabling unit cost reduction.

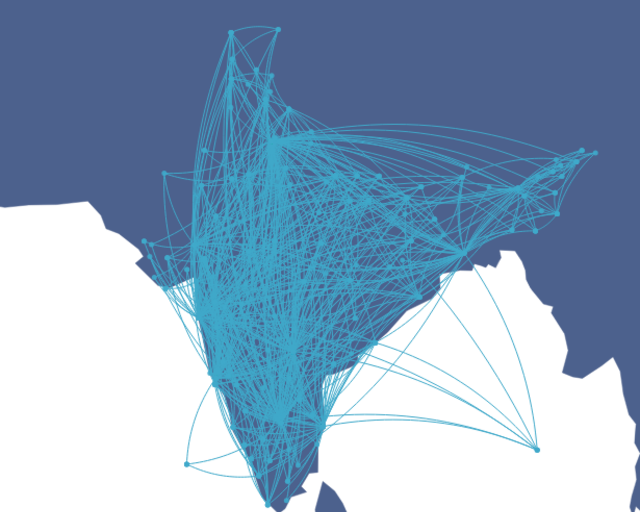

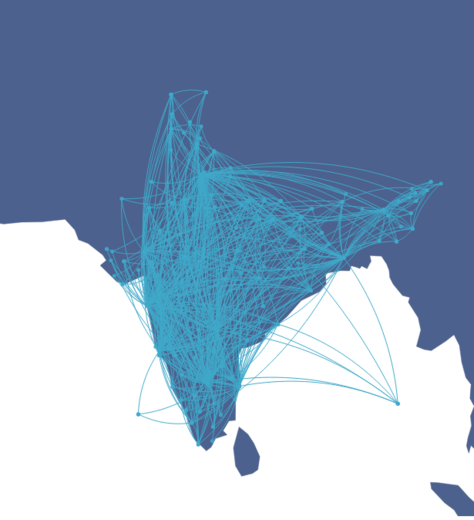

Air traffic development in Asia and the Middle East is driving the growth

Global passenger traffic, measured in Revenue Passenger Kilometres (RPKs), is forecast to grow at an average annual mid to long term rate of 3.6% until 2044. While mature markets will continue to expand at a moderate pace, some of the most dynamic growth is anticipated in Asia and the Middle East.

Fastest growing major traffic flows (annual growth):

- Domestic India: 8.9%

- Asia Emerging - PRC: 8.5%

- Asia Emerging - Middle East: 5.3%

This evolving traffic landscape underscores the increasing importance of versatile and efficient aircraft to serve a diverse range of routes and markets. Airlines can operate mixed single aisle and widebody fleets using crews with multi type ratings thanks to commonality between the A320, A330 and A350 families.

The fleet of tomorrow: 43,420 aircraft

To accommodate projected traffic growth and replace retiring aircraft, the world's passenger and freighter fleet is expected to nearly double, growing from 24,730 aircraft at the end of 2024 to 49,210 aircraft by the end of 2044.

Over this period, a total of 43,420 new aircraft will be required. This demand is segmented into:

- 34,250 typically single aisle aircraft: serving domestic and regional routes with increasing efficiency and range

- 9,170 typically widebody aircraft: connecting major international hubs but also regional high traffic routes, notably in Asia, supporting long-haul passenger and cargo operations

Crucially, approximately 18,930 aircraft deliveries will replace older-generation models. This fleet modernisation is paramount for enhancing operational efficiency and significantly reducing the environmental footprint of aviation per passenger kilometre.

Air transport is an essential contributor to the economy and society

Air transport is an essential contributor to the economy. It contributes to 3.9% of global GDP and generates 86.5 mn jobs.

Regarding the economy, depending on the country, the impact can be very significant. The air transport is critical for islands, landlocked nations and remote areas: it contributes to 25.1% of Iceland's GDP, for example. Air transport also helps develop tourism (58% of international tourists travel by air) and related economies: it contributes to 7.9% of Morocco's GDP and 6.8% of Thailand's GDP.

It also has a strong societal impact, connecting workers to their place of work: 155 mn people working abroad.

A doubling in the global in-service fleet will also generate a need for new pilots, technicians, cabin crews and create careers throughout the aviation eco-system. Huge opportunities will exist in aircraft maintenance and efficient operations as part of the sector’s sustainability drive.

Airbus forecasts strong growth for global air cargo market

The future of the air freight market is dynamic, driven by the expansion of global trade and economic development at world level. To meet this rising air cargo demand, the world's freighter fleet will require modern, more efficient aircraft, including new builds and specialised passenger-to-freighter conversions.

Our 20-year forecast for the air cargo industry indicates:

- The global dedicated freighter fleet is expected to grow by 45%, reaching 3,420 aircraft by 2044.

- Overall, 2,605 additional freighters will be needed for the market, 1,670 will be conversions from passenger aircraft and 935 will be new-build freighters.

- Air freight demand is projected to increase by 3.3% annually, effectively almost doubling cargo volumes.

- Asia-Pacific and North America will continue to lead this growth, reinforcing their role as key hubs in global trade flows.

This evolution highlights air cargo's critical role in connecting markets and reliably transporting essential goods worldwide.

Sustainability: a core imperative for aviation's future

The air transport growth comes with responsibilities: leading sustainable aviation.

To ensure that the growth in air transport, which is essential to economic and social development is sustainable, we need more fuel efficient aircraft. To achieve this, the levers of decarbonization are as follows:

- Use less energy: Airbus invested in its commercial aircraft business €2.7 bn of R&D in 2024 mainly related to aircraft technologies such as aerodynamics, structures, propulsion and operations (Skywise, predictive maintenance, Airbus services) to build more fuel efficient aircraft. Discover more about Future aircraft.

- Use decarbonised energy: such as SAF (sustainable aviation fuel), hydrogen and hybrid. All currently produced Airbus aircraft are 50% SAF capable - rising to up to 100% by 2030. Discover more about energy transition.

The most impactful near-term step towards decarbonising aviation is the accelerated introduction of latest-generation aircraft. Replacing older aircraft with newer more efficient ones is the quickest way to reduce fuel burn per RPK. The latest generation aircraft are delivering up to 25% better fuel efficiency and lower CO2 emissions than previous generation aircraft.

FAQs

What does GMF stand for?

GMF stands for Global Market Forecast

What is the GMF?

The Airbus Global Market Forecast (GMF) is a forecast shared every year to reflect future demand for air travel and deliveries over the next 20 years.

Is the GMF predicting forecasts per aircraft model?

The GMF is aircraft agnostic and does not forecast deliveries per aircraft model but demand by aircraft size.

What are the criteria taken into account in the GMF?

To determine the future demand for air travel, the Airbus GMF connects the drivers for air transport demand (macroeconomic, demographics…) with air transport affordability (expected yields evolution, taking into account SAF and CO2 prices).

Our latest news

Read more

-

Air Canada discloses order for eight Airbus A350-1000s

Press Release

Commercial Aircraft

Air Canada has disclosed a firm order for eight Airbus A350-1000 aircraft. Learn more about it. -

Delta Air Lines grows Airbus fleet with order for 31 additional widebody aircraft

Press Release

Commercial Aircraft

-

Recycled and ready

Web Story

Innovation

-

Airbus reports 793 commercial aircraft deliveries in 2025

Press Release

Commercial Aircraft

-

Airbus completes acquisition of Spirit AeroSystems sites

Press Release

Commercial Aircraft