More digital, more connected, more efficient

FUTURE FOR AFTERMARKET

The fundamental need to connect people and facilitate trade is what drives the aviation industry forward. To support this resilient global demand, the services that keep the world flying must evolve and grow. The Airbus Global Services Forecast (GSF) provides a comprehensive 20-year outlook on these critical needs, offering insights to help our airline partners operate with peak efficiency and reliability.

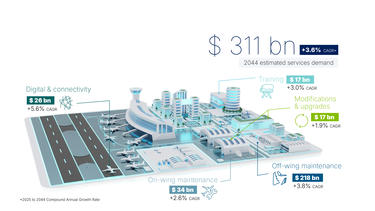

To support a global fleet that is set to nearly double by 2044, the requirement for services will grow in lockstep. This increasing need for maintenance, training, and digital solutions translates to a projected services value of US$311bn, illustrating the scale of the task ahead for the entire industry.

Download documents

2025-2044

Highlights GSF 2025-2044

Infographics GSF 2025-2044

Presentation GSF 2025-2044

Airbus projects resilient growth of services market in the next 20 years

2025-2044

Highlights GSF 2025-2044

Infographics GSF 2025-2044

Presentation GSF 2025-2044

Airbus projects resilient growth of services market in the next 20 years

The value of services market set to almost double in next 20 years

The five pillars of aviation support to 2044

To help airlines operate their fleets reliably and efficiently growing demand, the services industry will focus on five key pillars of support. These segments represent the core of the operational needs our customers will face over the next two decades.

Off-Wing Maintenance: The largest aftermarket segment, driven by essential component repairs, overhauls, and the need for spare parts. This area is foundational to long-term aircraft value and performance and is projected to reach US$218bn by 2044.

On-Wing Maintenance: Covering the crucial day-to-day line and base maintenance performed on aircraft, this segment is vital for ensuring high levels of fleet availability and reliability for operators. The market is forecast to reach US$54bn.

Modifications & Upgrades: This dynamic segment helps airlines enhance passenger experience, improve fuel efficiency, and ensure regulatory compliance through cabin retrofits and systems upgrades. It is projected to be a US$17bn market.

Digital & Connectivity: A rapidly growing segment focused on leveraging data to optimise performance, essential from predictive maintenance to enhancing passenger journey. This pillar represents one of the next frontiers for the industry. This is where we see the greatest potential to unlock the US$83bn in annual operational efficiencies that will help our airline partners thrive in a competitive future.

Training: The human element of aviation. This pillar encompasses the critical need for robust pilot and technician training programs to develop the 2.35 million new professionals required by 2044.

The 20-year services horizon

Focus on Digital & Connectivity pillar: a market set to triple

The most significant evolution in the aftermarket landscape is the accelerated adoption of digital and connectivity solutions. This market segment is forecasted to almost triple, reaching a value of US$26bn in 2044. This growth is driven by the clear benefits it delivers to airline operations:

- More efficiency, more savings: As air traffic grows, operational efficiency is paramount. Digitalisation and connectivity, thanks to the interconnection of data, artificial intelligence, machine learning, drive transformative enhancements on predictive maintenance, real-time fleet monitoring, and optimised flight paths. These improvements boost aircraft availability, reduce fuel consumption and CO2 emissions, and minimise disruptions. We project these efficiencies could save airlines up to US$83bn in 2044.

- Enhanced experience: in-flight connectivity and digital services for passengers are becoming essential for enhancing the overall travel journey and creating new ancillary revenue opportunities for airlines.

Focus on Training pillar: people at the heart of our industry’s future

Supporting this global growth requires a substantial increase in skilled aviation professionals. Our forecast estimates that 2.35 million new pilots, technicians, and cabin crew will be needed over the next 20 years to support the expanding global fleet.

This demand is split between growth in emerging economies and the need to replace an ageing workforce in more mature markets. Investing in new training technologies and career pathways will be essential to attract and retain the talent needed to ensure our industry’s future.

Expanding the services ecosystem with ground operations and maintenance operations support

Beyond the core segments, we see growing customer demand in two related fields that support the aviation ecosystem:

Maintenance operationssupport: Includes essential enablers such as engineering services, technical records, and inventory management for MROs and operators. It is estimated to be worth US$100bn in 2044.

Ground operations: A critical link for airside efficiency and aircraft turnaround performance, where new technologies are driving service innovation. Ground operations are expected to create a demand valued at US$74bn by 2044.

Regional perspectives: growth shifts eastward led by South Asia, China and Asia-Pacific

By 2044, only Asia-Pacific, China, and South Asia regions are projected to represent ~45% of the overall services demand, driven by a rising middle class and increasing demand for connectivity.

South Asia, in particular, is forecasted to have the highest growth rate over the period (+8.8% 20-year CAGR) while Europe & CIS will represent the largest 20-year cumulated demand (22% of the total value).

This geographic shift will require a corresponding evolution in the global services footprint to support airlines where they operate.

FAQs

What does GSF stand for?

GSF stands for Global Services Forecast

What is the GSF?

The Global Services Forecast (GSF) is a comprehensive analysis of the aviation aftermarket. It provides a 20-year outlook (2025 to 2044) on the demand for services such as maintenance, upgrades and modifications, training, connectivity and digital solutions that support the global aircraft fleet for all passenger aircraft of 100 seats or more and freighters over 10 tonnes.

What are the criteria taken into account in the GSF?

To assess the future demand of services, Airbus GSF connects the drivers of aircraft demand (from the Airbus Global Market Forecast) and the dynamics & specificities of services market directly supporting aircraft operations (in-service fleet, flight cycles, aircraft age and type, etc.).

Why did you change the GSF market breakdown?

Our 2025 figures come in continuity with the previous 2024 GSF report, although our analysis employs a more detailed clustering approach to better reflect the aftermarket reality. It now categorises into five main streams (Off-wing Maintenance, On-wing Maintenance, Training, Modifications & Upgrades, Digital & Connectivity). To go beyond and explore other relevant markets, we also introduce 2 additional streams, separately from the overall figures (maintenance operations support, ground operations).

What is the services market growth from 2024 to 2025?

Services Market growth is 7% YoY.